The Hold Account functionality can also be known as an interest reserve or suspense account. This functionality allows you to hold funds when there is an amount overpaid which will then be used for future payments.

To get started with this, access an existing loan. Then, if your loan has an upfront balance of funds provided by the borrower, proceed by making a scheduled or unscheduled payment to designate those funds as hold account funds. It is suggested to make an unscheduled payment so it does not impact the first regular recorded payment. However, it can all be done in one step as a regularly scheduled payment as well, which will be explained below.

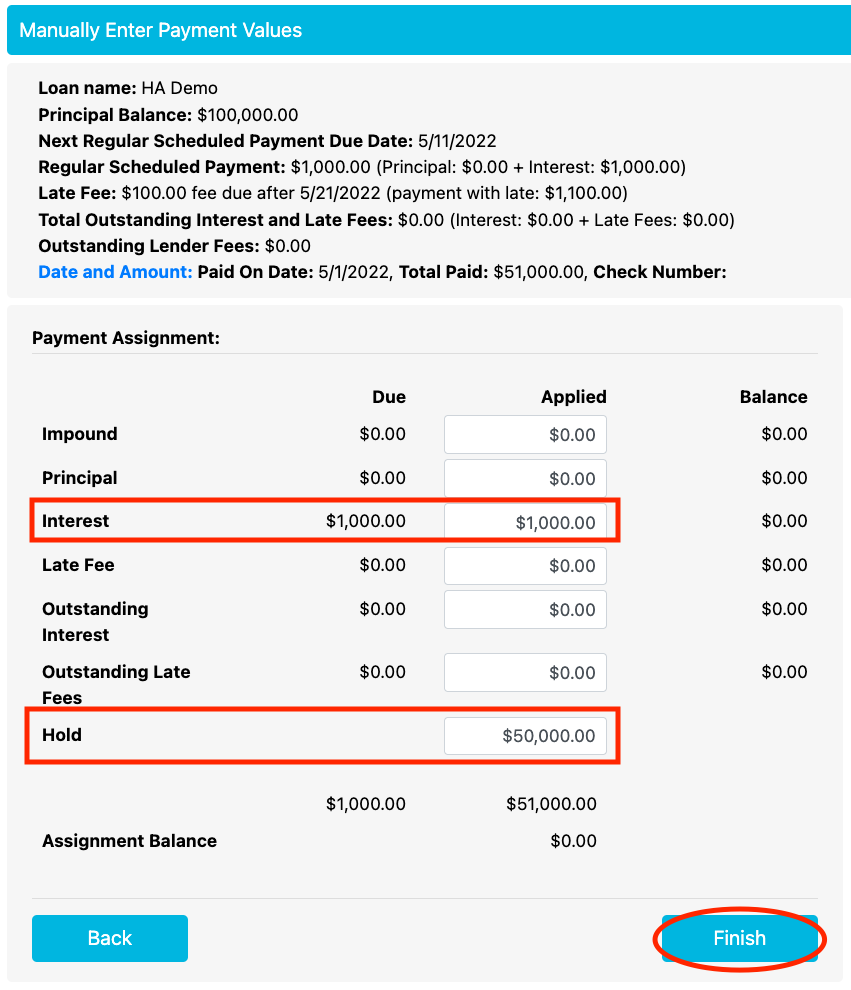

For our example, we're working with an Interest-Only Revolving loan of $100,000 with $50,000 of funds to designate to the holding account. If the borrower made a $1,000 payment upfront as well you can designate a total regular scheduled payment of $51,000 with $1,000 going to interest and $50,000 going to the Hold Account.

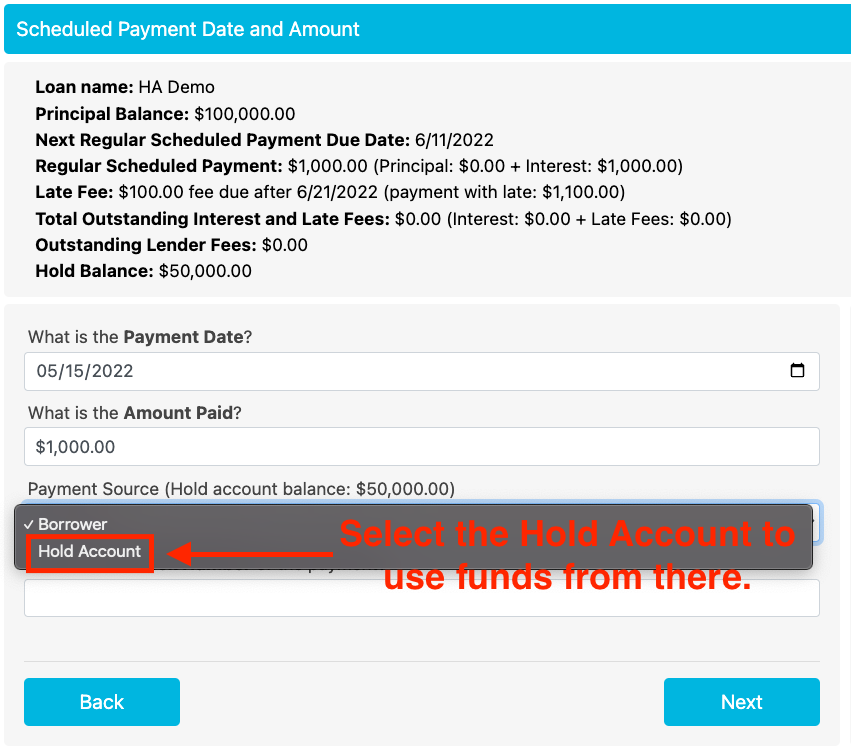

Now, to use these funds you would make the following regular scheduled payment and you'll be given the option to select the holding account as the payment source.

Once the Hold Account is selected click next to successfully use the hold account's funds.

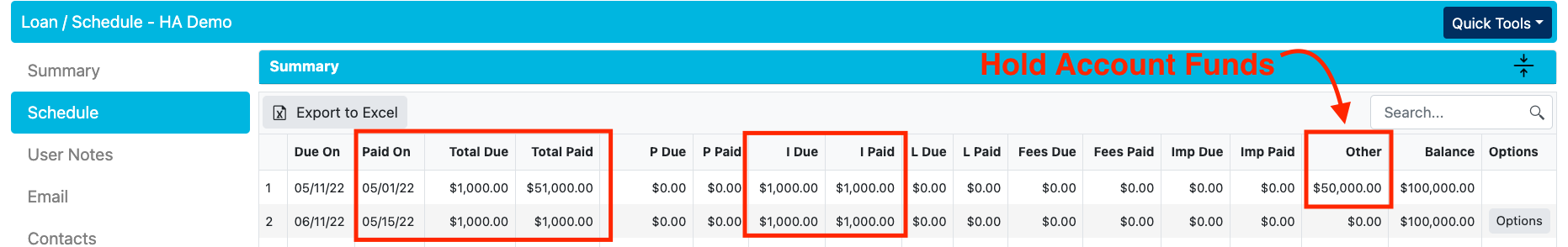

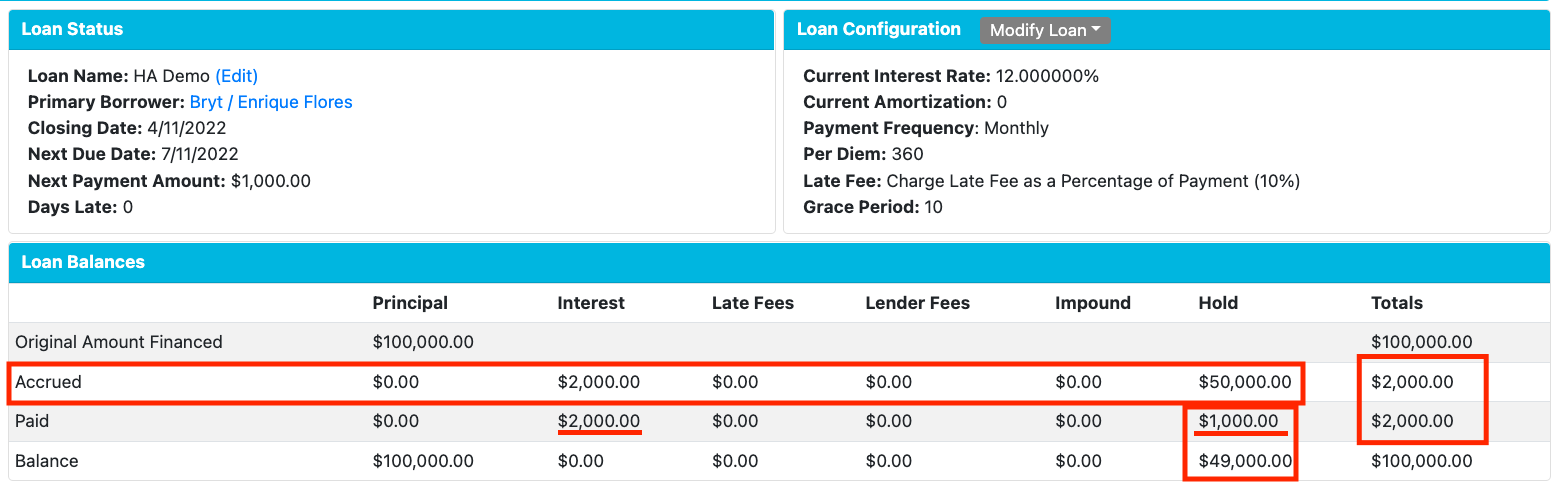

The payment made using the Hold Account will now be reflected in the loan's summary. Including the previously paid $50,000 into the Hold Account as an 'Accrued' amount.

That concludes the Hold Account functionality walkthrough.

If you encounter any issues please contact Bryt Support.