- 25 Apr 2025

- 8 Minutes to read

- Print

- DarkLight

Impound (Escrow) Module

- Updated on 25 Apr 2025

- 8 Minutes to read

- Print

- DarkLight

Impound (Escrow) Module Overview

What is an escrow or impound account?

An impound account, sometimes called an escrow account depending on where you live, is set up by your lender to pay certain loan-related expenses. The money that goes into the account comes from a portion of the periodic payment. An escrow account ensures that these expenses are paid because the lender or servicer is collecting and paying on behalf of the borrower. The most common impound accounts are for taxes and insurance, but Bryt users can use the impound module for any expense that they are collecting and paying on behalf of the borrower.

Features of the Bryt Impound (Escrow) Module include:

- The ability to add an unlimited number of impound accounts. In addition to property taxes and insurance premiums, the impound feature can be used to collect any obligation that the lender is paying on behalf of the borrower.

- Each impound account can be set up for a specific amount over a specific time period. Impound amounts can be modified throughout the life of the loan to reflect changes in the impound payment obligation.

- By default, impound amounts are prioritized in the payment process, meaning impound is collected before any other items are paid (including principal and interest). Users have the option of changing this when they accept the payment.

- Impound amounts are included on the schedule, payment request, and any other documentation that is sent to the borrower.

- When impound payments are made to the vendor and recorded in Bryt, they are associated with a contact in the Bryt contact database. You will have a running history of vendor payments over the life of the loan.

- Bryt uses double-entry accounting for impound accounts providing accurate loan accounting for impound accounts. The Bryt “register” includes all entries associated with impound accounts.

To Access the Impound Module, click on the Impound tab on the left side of the loans page:

You will notice that by default the impound schedule is generated with a $0 amount due for all periods of the loan:

To add an Impound Fee, click the "Add Impound Fee" in the upper left corner of the loan summary:

When the impound summary page opens, you can add the following information about your impound:

- Name - This is what you call the specific impound, for example, "Property Tax" or "Insurance".

- Description - You can add a description to further describe the impound.

- Amount to collect per period - This is how much you want to collect for each pay periodimpound.

- Starting with payment on - This is the beginning pay period for the impound.

- Collection Options - This field tells Bryt how long to collect the impound.

- Choosing "Until the end of the loan " - will cause Bryt to collect the impound until the loan ends

- Choosing "For a specific number of pay periods" will expose another field, "Number of periods to collect fee" to allow you to select how long to collect the impound

When you are satisfied with your choices, click "Save". This will populate the Impound Fee Schedule. You can have as many impound accounts as you need for a loan. The Impound Fee Schedule will show:

- balance of collected impound towards an impound account

- future projected impounds

- payments of impound funds

To edit the name and description of your impound, click the "Edit" button.

To change an existing impound, click the "Modify" button.

NOTE: Once a payment has been paid towards an impound fee type you cannot delete that impound fee type. ex. Taxes & Insurance

Note: If you ever need to stop collecting an Impound fee once it's been added to a loan, you would use the 'Modify' button and set the amount to $0 as of the next pay period's date.

You can only modify impound for payment periods that have not been settled. Click "Save" to update the new impound settings and update the schedule.

Once you apply an impound fee on a loan, your loan Schedule will display two additional columns for Impound Due and Impound Paid:

You will also have a field for impound on the Record Payment page.

Note: By default, Bryt will prioritize the payment applied towards Impound over Interest and Principal. If Impound goes unpaid, it is not tracked - you would need to add an additional one-time impound fee for a future pay period to catch up on that collection.

When you want to pay an impound, select "Pay" from the list of options for the impound account you are pulling funds from.

When impound payments are made to the vendor and recorded in Bryt, they are associated with a contact in the Bryt contact database. You will have to specify the Paid On date, Amount, Check Number, and Contact being paid.

Click "Save" to apply the payment.

If the contact does not yet exist, you can add a new contact from the payment screen.

You will have a running history of vendor payments (Impound Payouts) over the life of the loan. The amount paid to the vendor will also reduce the impound balance and update the impound schedule.

Impound Fee Schedule Buttons

The Impound Fee Schedule now includes a 'Pay Borrower' and 'Export to Excel' button.

Pay Borrower - allows you to create a register and payout entry in the impound fee schedule history, to pay out any impound balances to the borrower after the loan's been paid off.

Show Projections - Projected impound payments no longer appear by default (they used to appear by default); this button will show those projected payments if needed for reference.

Export to Excel - allows you to get an Excel file of the current Impound Fee Schedule's activity.

Deleting an Impound Payout

To Delete a payout, you'll want to click on the Impound's carrot to expand a drop-down menu. Then you'll see tabs for Collection Amounts and Payouts, you'll want to click on the Payouts tab to see payouts and associated details. In the Options column for a payout, you'll see a Del button to delete that payout.

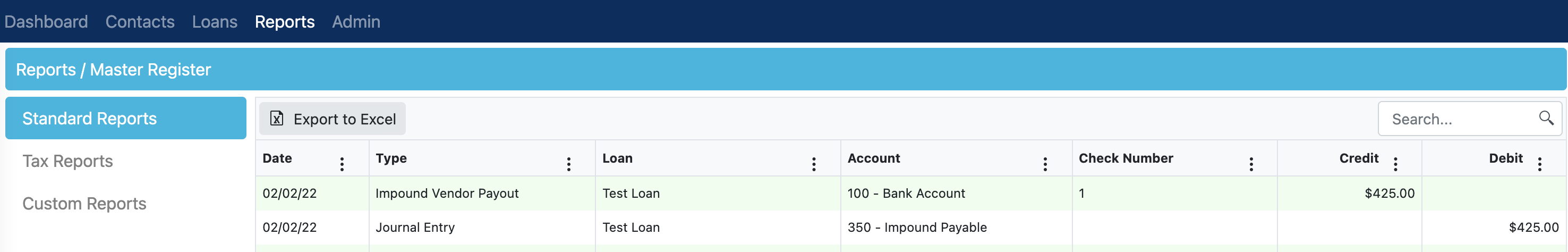

Bryt uses double-entry accounting for impound accounts providing accurate loan accounting for impound accounts. The Bryt “register” includes all entries associated with impound accounts.  Loan Register

Loan Register

Master Register

Master Register

Optional: Impound Projections

Once you have added Impound Fees, you're able to add projections for each fee you've added. Impound Projections will allow you to be prompted via Loan Issues of upcoming expected payout dates. The two areas you would see this are via the Dashboard's Loan Issues widget, or via the loan's Summary page. You can set the number of days before the Impound fee's projected payout dates.

To start, you'll want to click the 'Add Projection' button.

1) You'll select the Impound Fee this projection is for

2) Set the Projection date for the expected Impound/Escrow Payout date

3) Set the amount you expect to pay out for something like Taxes or Property

4) You then have a checkbox to check and reveal an additional field for you to set the number of days before this projection's payout date

Once you click 'Save' that'll be set up and the Loan Issues notice will appear 15 days before the payout's date.

You can set multiple projection payout dates if you expect to service the loan for several years. Once you click 'Pay' to make a payout for the Escrow fee type and it has an associated projected payout to be notified, the system will prompt you with a message stating the most recent projection will be removed once the payment is made (it'll be deleted by default so the new projection can take its place).

The 'Edit' button allows you to Edit the Impound Fee's Projection details such as the date, amount, or enable/disable a Loan Issue reminder.

The 'Delete' button will allow you to delete the added Projection.

Optional: Dynamic Impound Fee

To start, you'll want to navigate to the Impound tab on the left-hand side list of a loan. You'll need to have the Impound module added and the user account claim to be able to see and use this feature.

The Dynamic Impound fee is based on the selected category's due amounts for the observed pay period.

Click the 'Add Impound Fee' button.

You'll be prompted to set the following details:

- Name: A name for the impound fee.

- Description: To help describe the purpose or goal of the impound fee.

- Collect Impound On: Either a Fixed Amount or from a Percentage of Payment Categories

- Rate for Percentage Categories: Percentage rate charged on selected categories.

- Starting with Payment on: By default, selects the first available due date to apply the fee towards. Or you can have it start at a different pay period.

- Collection Options: To collect until the end of the life of the loan or for a specific number of pay periods.

- Number of Periods to Collect fee: Designates a number of pay periods to start collecting the fee (set from Starting with Payment on).

Before the Impound Fee Application

Click Save once you're done entering all the settings for the Impound Fee.

After Applying the Impound Fee

This fee applied Impound to Interest, Late fees, and Lender fees. However, there were no lender fees set up for this example.

Once the Impound Fee is set up, you can Edit the name of the fee or make a payment towards this Impound using the Pay button (Same as covered in this article before the update to include dynamic impound fees).

The difference with this Dynamic Impound Fee update is that the Modify button will allow you to switch between the Impound Fee types and allow you to select or deselect Impound Fee categories.

Once you're satisfied with the Impound fee modifications, you can click Save to finish applying those changes.

Mortgage Insurance Premium (MIP)

If you'd like the Impound fee paid amounts to be summed and applied towards the 1098 form's Mortgage Insurance Premium you'll want to select 'Yes' for this option.

Then click save if you're done setting up this Impound fee.