- 06 Apr 2024

- 3 Minutes to read

- Print

- DarkLight

Interest Accrual Methods (Bryt's Math Calculations)

- Updated on 06 Apr 2024

- 3 Minutes to read

- Print

- DarkLight

Bryt has different interest accrual method options for you to match your preferred interest dues over the life of a loan. It is important to understand these accrual methods, their differences, and how each is calculated - so this guide will help with that.

Breakdown of Bryt's Interest Accrual Options

While Bryt can be configured for standard accrual methods (Periodic 30/360, Actual/365, Actual/360) we have built in the ability to perform variations of the standard methods by using different combinations of:

1) Payment Frequency,

2) Interest Day-Count, and

3) Per Diem

1) Payment Frequency determines the regularity of a loan's dues.

Payment Frequency options in Bryt are:

- Monthly – payment occurs every month on a specific date

- Quarterly – payment occurs every three months on a specific date

- Twice monthly – payment occurs two times per month on specific dates

- Weekly – payment occurs every week on a specific day

- Every other week - payment occurs every other week on a specific day

- Annually – payment occurs once a year on a specific date

- Single Pay Period - Payment will occur once on a specified future date

2) Interest Day-Count is how we calculate the number of days between two payment dates.

The following settings are available for Interest Day-Count:

- Periodic (Even 30-Day Pay Periods) – uses the same number for each period, even though the periods may vary.

Example: Months are always counted as 30 days, regardless of the actual number of days in the month

- Actual Days (365) - counts the actual days in the pay period.

Example: Days of the month might be 28, 29, 30, or 31 days

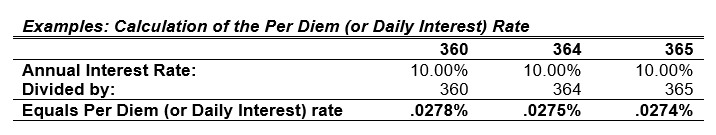

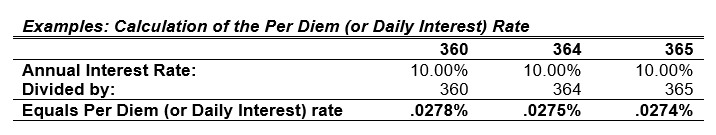

3) Per Diem (or Daily Interest) is the interest charged on a loan daily.

This term is also referred to as the Daily Accrual. We use Per Diem (or Daily Interest) to calculate prorated payments as well as the interest due for a specific Payment Frequency. The following settings are available for Per Diem (or Daily Interest):

- 360 divides the Annual Interest rate by 360 to get the Per Diem (or Daily Interest) rate -

Many commercial and residential loans use this method to calculate the Per Diem rate as it produces a slightly higher daily rate. Combining this Per Diem calculation with the Actual Days (365) Interest Day-Count produces the most interest for your loan. - 364 divides the Annual Interest rate by 364 to get the Per Diem (or Daily Interest) rate -

This method is generally only used for Weekly or Every other week Payment Frequencies. - 365 divides the Annual Interest rate by 365 to get the Per Diem (or Daily Interest) rate

Accrual Combinations and Effective Interest Rate Results

The following is a list of the most common accrual methods:

- Periodic/360 is commonly used in consumer transactions (like mortgages, otherwise Actual Day loans don't amortize evenly) or commercial transactions. We favor Periodic/360 loans because they will save you time and money, despite alternative options attempting to maximize profits.

- Actual Days/360 (365/360) is commonly used in commercial transactions. Many lenders favor this method because it returns a slightly higher effective interest rate.

- Actual Days/365 (365/365) is commonly used in commercial transactions.

Note: Only Actual/365 will provide an additional option to factor in an extra day for 'leap years' (For Monthly payment frequency loans). Submit a request to support@brytsoftware.com if you'd like this option for Actual/360.

The following chart describes how to configure Bryt for these common accrual methods. It also shows the difference in effective interest rates for these configurations.

Common Interest Accrual Methods | Periodic 30/360 | Actual/360 365/360 | Actual/365 365/365 |

Configure the settings in Bryt as follows: | |||

| Interest Day-Count Setting in Bryt | Periodic | Actual | Actual |

Per Diem (or Daily Interest) Setting in Bryt | 360 | 360 | 365 |

Effective Interest Rate charged: | |||

Actual Annual Interest Rate | 10.00% | 10.00% | 10.00% |

Per Diem (or Daily Interest) rate Equals Annual Interest Rate divided by Per Diem Setting | .0278% | .0278% | .0274% |

Number of Days of Interest collected during the year. | 360

| 365 | 365 |

Effective Interest Rate | 10.00% | 10.14% | 10.00% |