- 25 Apr 2025

- 8 Minutes to read

- Print

- DarkLight

Investments

- Updated on 25 Apr 2025

- 8 Minutes to read

- Print

- DarkLight

Note: A loan's borrower(s) cannot be the investors (lenders) within the same loan. We suggest creating a separate contact if there will be a person who will be a borrower and a lender. This way interest paid on a loan (1098 - borrower) or interest received from a loan (1099 - lender/investor) can be accurately tracked and a different bank account can be used if needed.

Guide Start

With the investments module, you'll see new options throughout different areas in the Bryt system. One of the new steps during the loan creation process will be to assign a share of the late fee that will be distributed to the servicer (vs lender) option. (Image below)

Setting up Investors

The first thing you'll be required to do using the Investments add-on module is to navigate to the investment loan you've created and access the Investments tab on the left-hand list.

Once you're at the Investments tab for the loan. You'll then see the Investments Summary, from there you can start adding an Investor (required prior to adding fees/impound or recording payments) by clicking on the 'Add Investment' button.

After clicking the 'Add Investment' button you'll be prompted to select a contact (investor) and set a start date for the investment.

- Select a Contact - Choose the investor you'd like to assign.

- Select a Start Date - Choose a start date for the investor's investment period (closing date selected by default).

The following page will ask you to set an investment amount, you can either have the system auto-calculate the amount assigned to this investor by setting the percentage of ownership under the 'Ownership' field or by setting the dollar amount under the 'Investment Amount' field. (Note: to have the amounts auto-calculated, make sure to click outside of the entry field box.)

After setting the investment amount and ownership percentage, you have the option of adding fees on this screen.

Note: If you are adding yourself (servicing entity) as an investor, you will want to add a servicing fee of 100%, since all money would be received by yourself anyway.

Alternatively, you can leave no Fee assigned and you can refer to investor payouts (instead of servicing payouts) to yourself as an investor (this way you can generate a 1099 form for yourself if needed).

Most importantly, you will want to make sure you only use one of these options consistently across all loans so you can later reference "servicing" payouts.

Explanation of Fee Payouts

The 'Add Fees' option here is what the servicer will receive (yourself, as the Bryt account holder) based on a spread from the loan's interest earnings (aka 'Points' or 'Spread').

For example, a 12% $100,000 Interest-only loan with a $1,000 interest amount paid with a single investor assigned, entering a Fee here of 6% (50% of the interest) will yield $500 to the servicer. With 2 lenders/investors assigned to the loan, each lender assigned a 6% fee, you'd receive $250 from each of them. If you put 12% on a single lender loan, you'd receive the full $1,000 interest earnings (100%) for the loan. Essentially, the loan rate is the cap for how much you can receive.

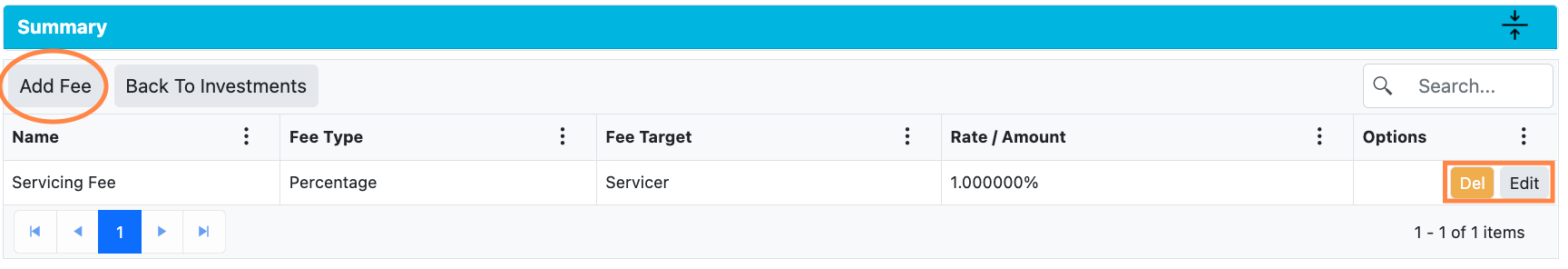

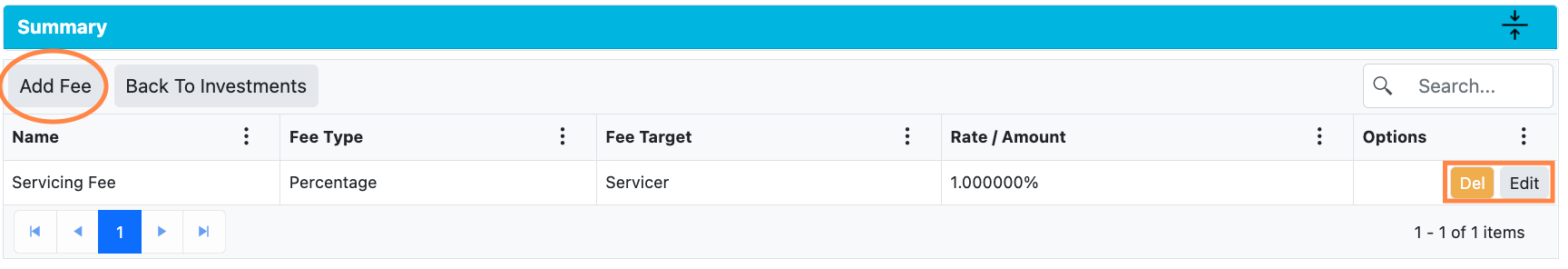

You can either charge a 'servicing fee' of 1%, or you can charge a flat rate if you'd prefer by using the drop-down arrow on the 'Fee Type' box once you're adding a fee (after clicking the 'Add Fee' button).

You can either charge a 'servicing fee' of 1%, or you can charge a flat rate if you'd prefer by using the drop-down arrow on the 'Fee Type' box once you're adding a fee (after clicking the 'Add Fee' button).

After you've added the fee you can either delete the created fee by clicking the 'Del' button or click on the 'Edit' button to return to the 'Add Fee' creation screen.

Once you're satisfied with the fees you've set, you can click on the 'Save Investment' button to finish adding your investor and their configuration for this investment.

From here you'll see that there's an Investment Error prompted (if you've not finished setting investors to reach the 100% funding amount for the life of the loan) in the Investment Summary Tab.

In the image below you'll see that once you've set another investor to fulfill the remaining investment the error will disappear.

In the image below you'll see that once you've set another investor to fulfill the remaining investment the error will disappear.

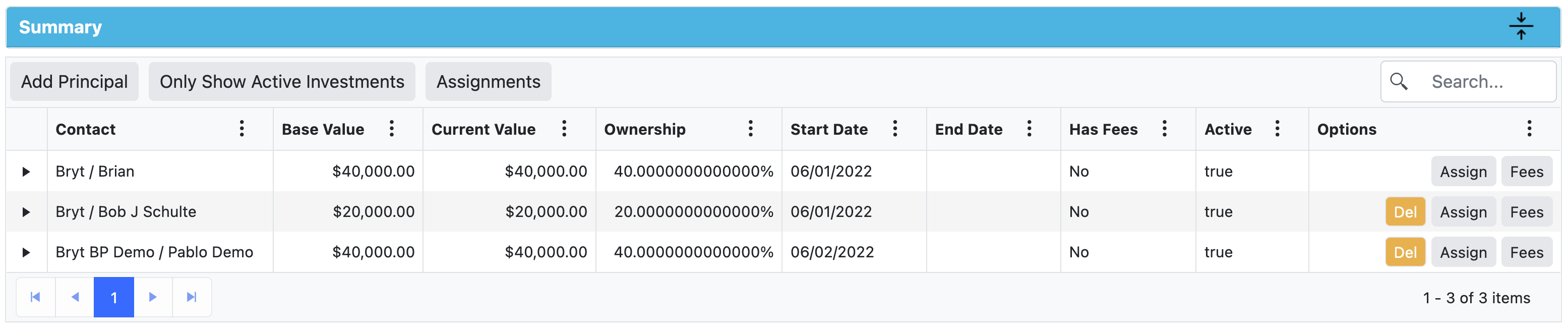

Managing Investors

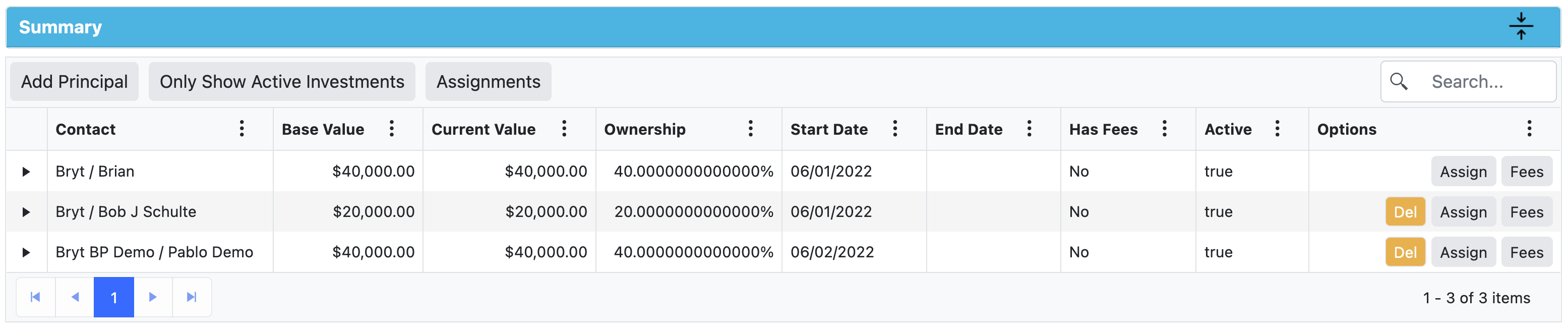

Once the red funding error banner is gone, you have three button options to delete an investor using the 'Del' button, change the investment period dates and amounts for an investor using the 'Assign' button, and modify existing or add fees for an investor using the 'Fees' button.

- Del - Deletes an investor.

Note: The delete button disappears if you have recorded a payment on a loan. If you would like to change that investor or amount, you would need to delete all payments, back out the investor/investments then re-record the payments.

This is a dependency restriction, if you were to delete the investor then where would their payout amount have gone, this is why we block that ability. - Assign - changes an investor's ownership in the loan.

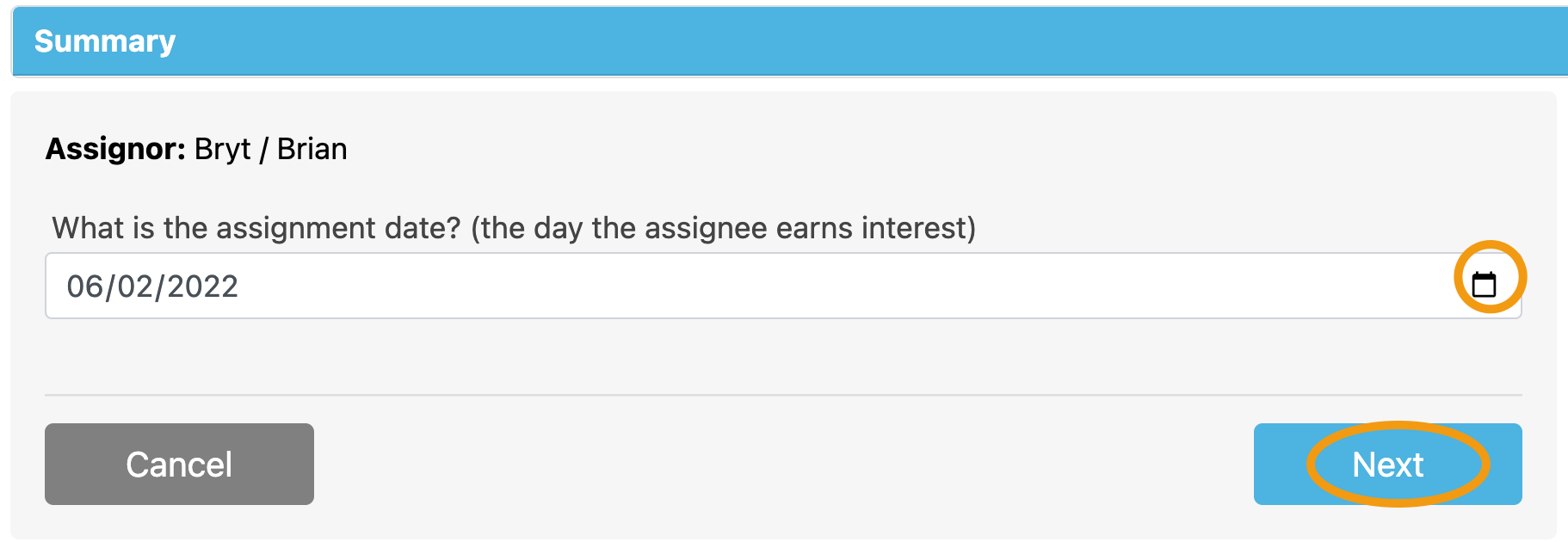

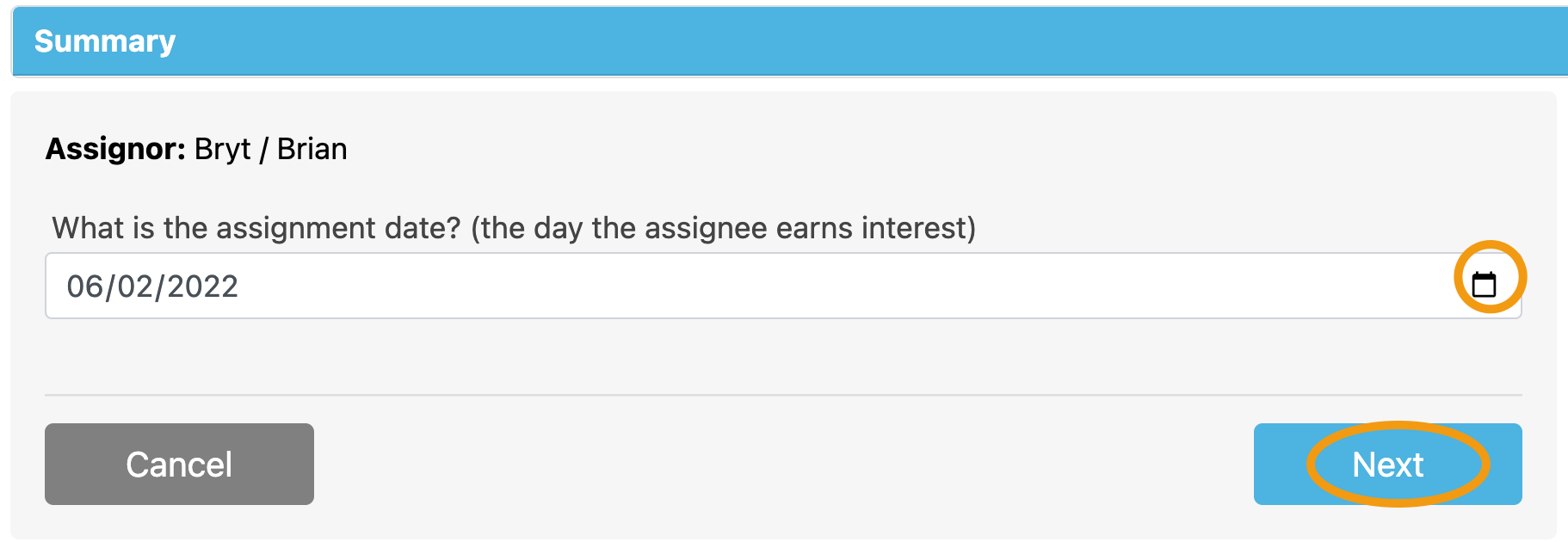

- When clicking the 'Assign' button on an investor (Assignor), the first step will ask for an assignment date. This will be the first date the Assignee (new investor) will start earning interest on this new investment assignment.

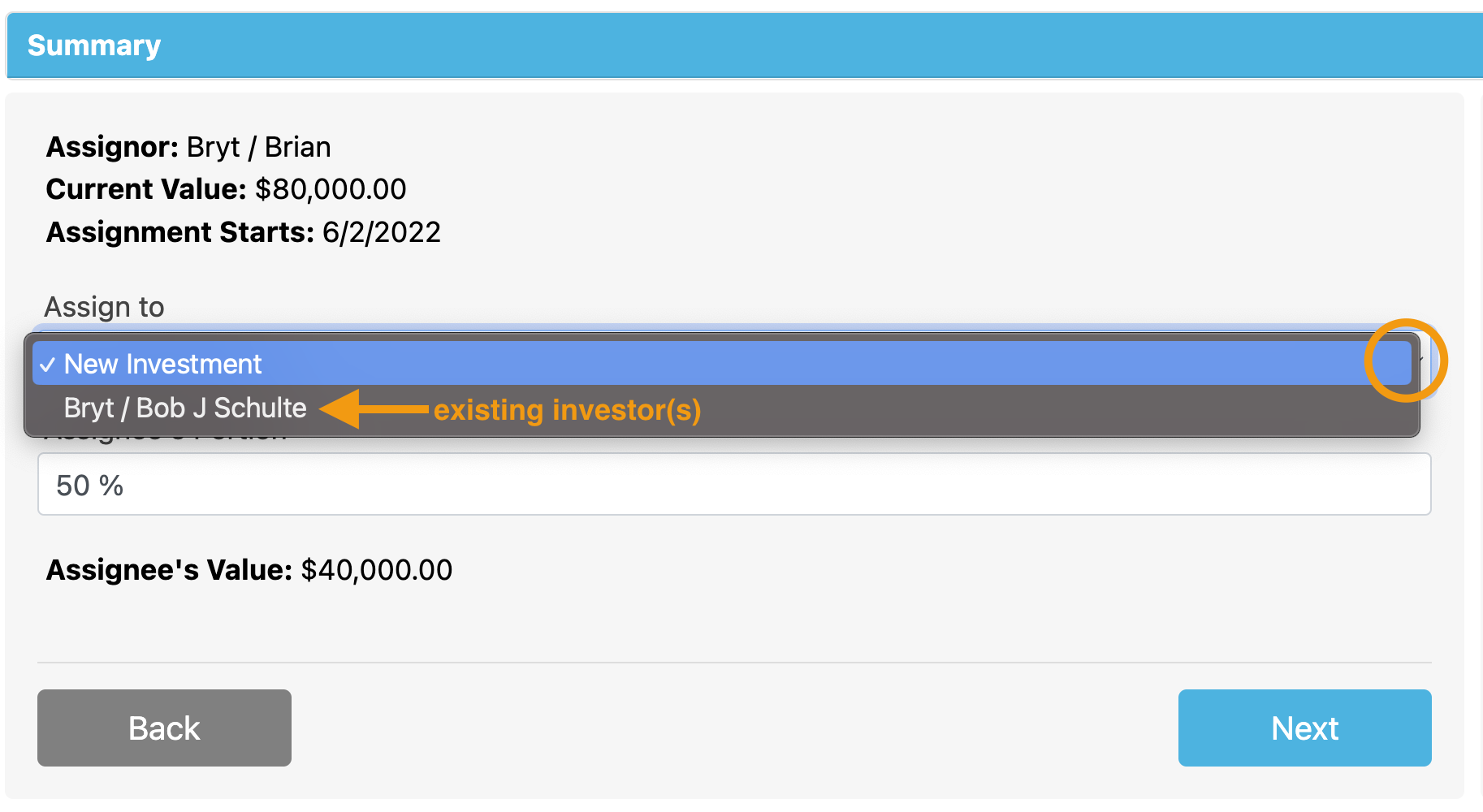

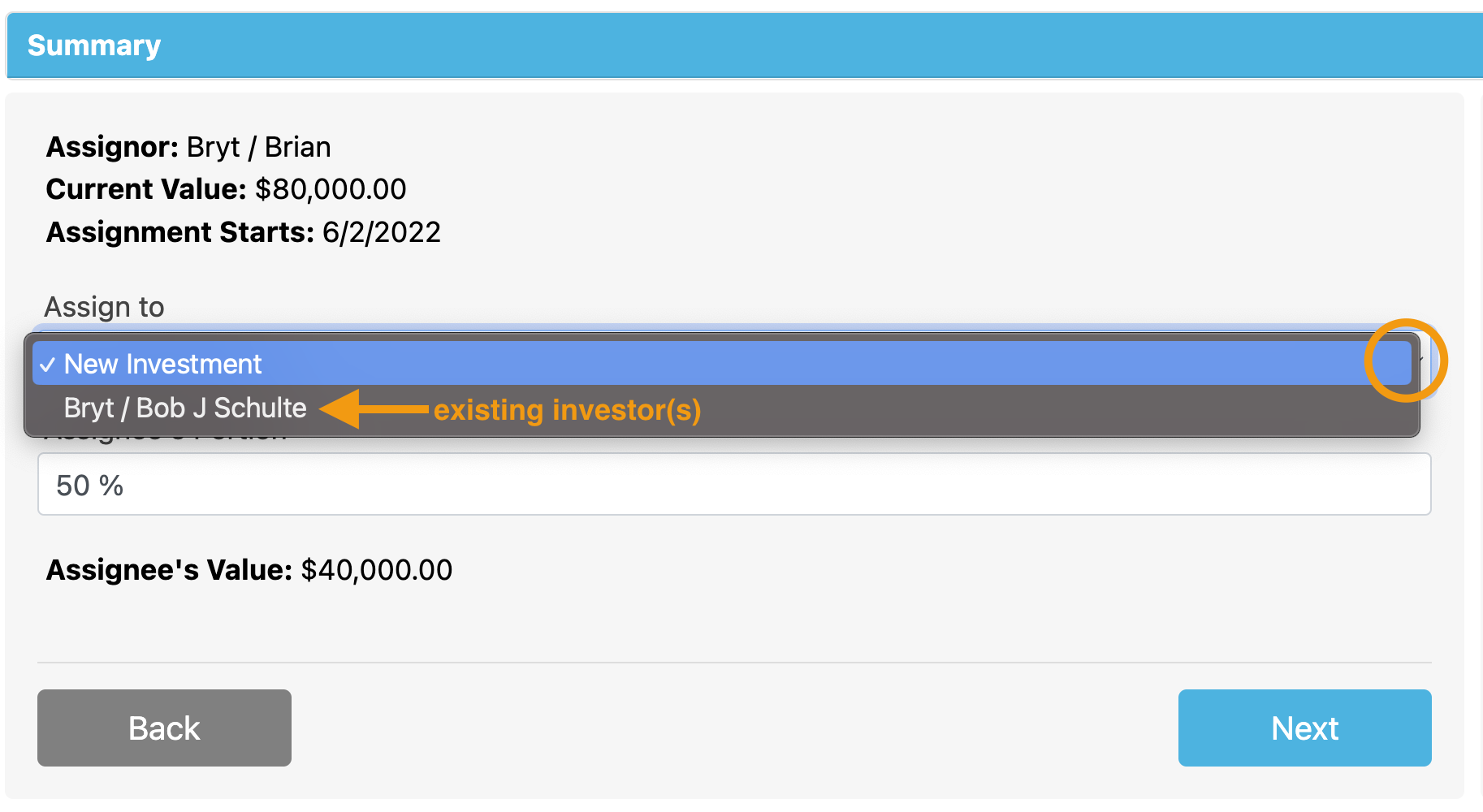

- The next step will ask who to assign it to. You'll have the option of setting a New Investment or setting a partial or full percentage to an existing investor from a drop-down list.

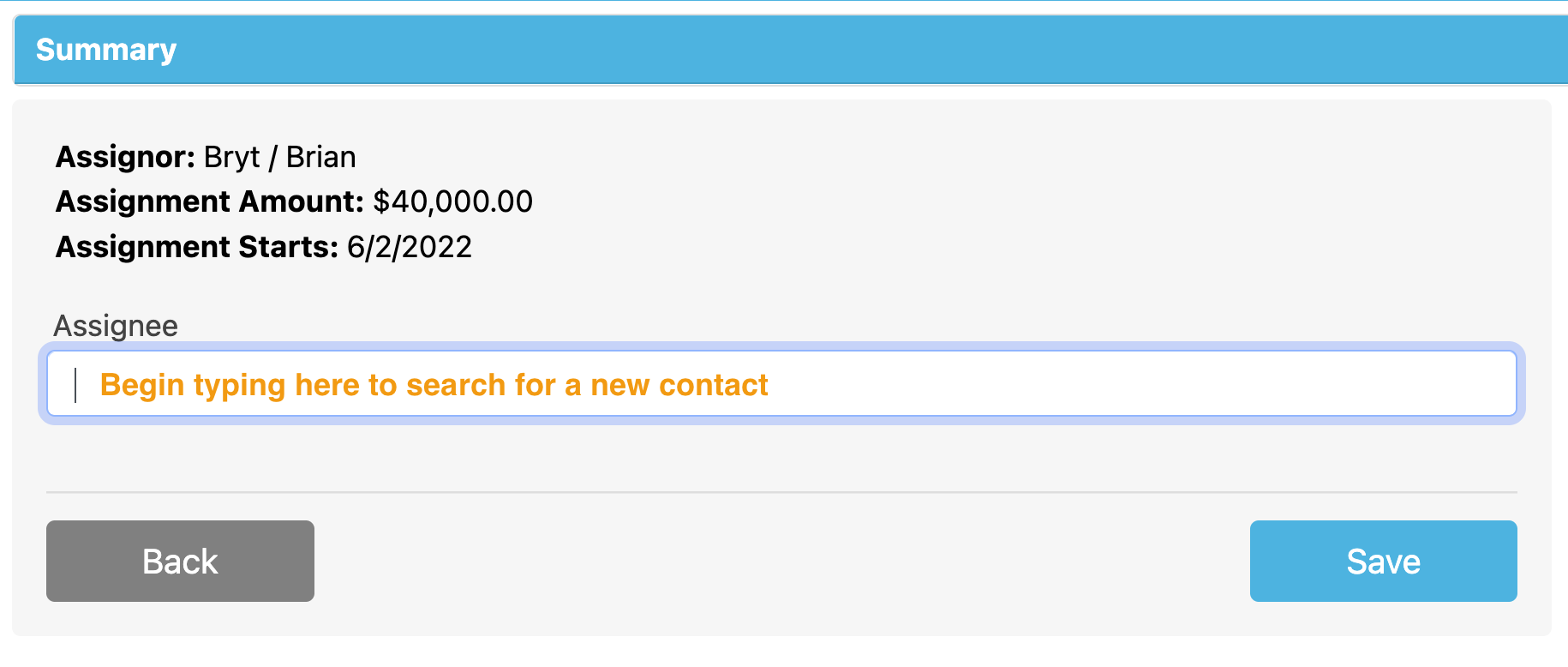

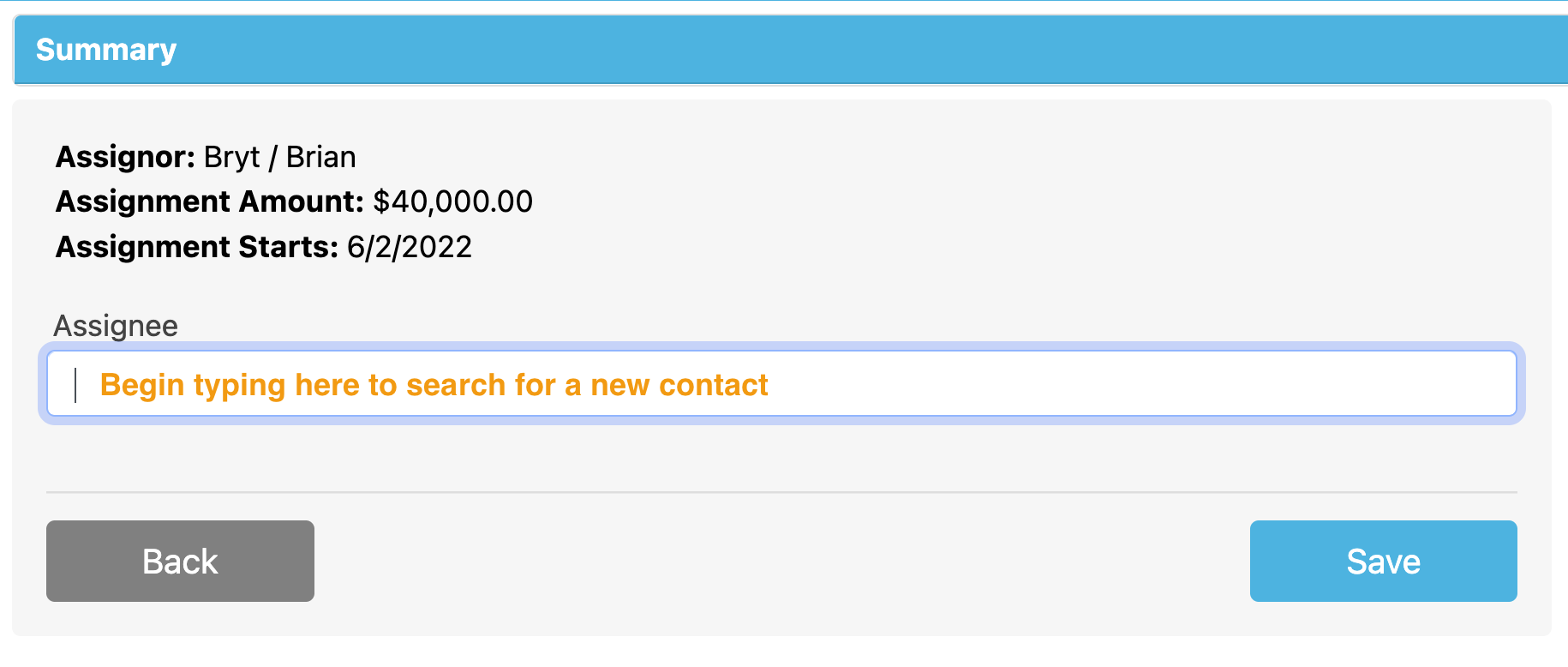

- If going with a 'New Investment' option, you'll be prompted to search your existing contacts list to select a new investor for the loan.

Then click 'Save' to save the new investor once they've been selected.

Then click 'Save' to save the new investor once they've been selected.

The following is the result of the new investor assignment:

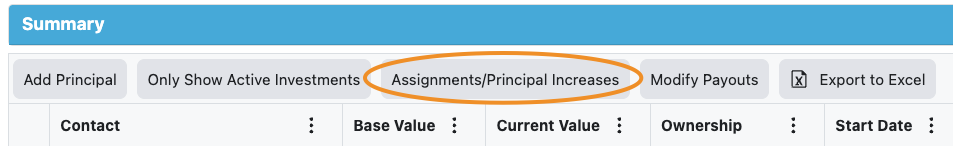

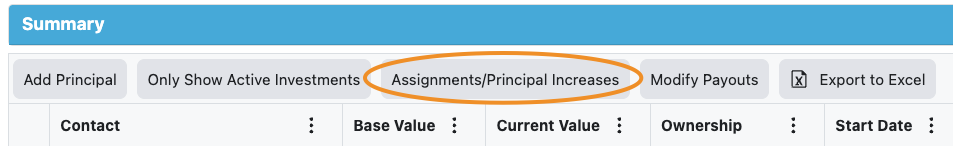

- After assigning a new investor, you'll see a new 'Assignments / Principal Increases' button appear, which allows you to review or undo those (only after assignments or principal additions have been made).

- When clicking the 'Assign' button on an investor (Assignor), the first step will ask for an assignment date. This will be the first date the Assignee (new investor) will start earning interest on this new investment assignment.

- Fees -modify existing, delete, or add fees for an investor

'Add Principal' button and the 'Assignments / Principal Increases' Button

After you've fully funded the loan (the red banner goes away), you'll see an 'Add Principal' button appear instead of the 'Add Investment' button. Please refer to the main principal additions guide for steps and more information.

When adding principal to a loan after the original loan amount is funded, only after will you see the 'Assignments / Principal Increases' button appear (just like when you use the 'Assign' button). This is a dual-use button for Assignments and/or Principal additions (increases).

When adding principal, this 'Assignments / Principal Increases' button will allow you to delete an added principal amount, whether the incorrect date or amount was added. You'll only be able to delete the added principal amount if the date it's added for has not already been paid for.

Added Principal Entry:

After a Payment is recorded for its pay period, the 'Del' button disappears:

This is expected system behavior for any recorded payments, it's a dependency restriction to prevent the user from editing rates and various settings (which cause inaccuracies in future periods). A recorded payment would need to be deleted and re-recorded once a correction is made to rectify any data entry errors.

Modify Payouts Module

The 'Modify Payouts' module is an add-on to the investment module and allows you to reassign principal returned to investors (when principal is paid by the borrower). Please follow this guide to learn more.

Explanation of Fees and Payouts

Fees also known as "Servicing Fees" (name them what you'd like) that'll be collected on behalf of the servicer as part of the interest that's paid over the life of the loan.

Any principal paid stays as the investor's, so there's no reason why it would be paid out to the servicer since it's the investor's money.

As for the interest, if there are two investors with 50% - $50,000 ownership ($100,000 total) and there's an interest income for a given month of $1,000, both investors would get $500 each. If each has a servicing fee of 1% on a 12% rate loan, that would yield $41.66 from each investor toward the servicer for a total of $83.33. If you're looking to get a servicing portion from the overall note/interest rate, you'll want to simply subtract your "points" (percentage) from the total and assign it as a Fee under each Investor. In the example described, you'd enter 1% as a servicing fee for each investor out of the 12% interest rate that's been set for the loan.

Note: In this 12% rate example, if you enter a number larger than 12% for the servicing fee, it'll still be 100% of the interest going to the servicer (yourself). Hopefully, this clears up any confusion, entering a 6% fee on a 12% loan would mean 50% of the interest income on a payment made by the borrower would go to the servicer. Further Math Breakdown examples are at the end of this article.

Then there are splits for Late fees and Lender fees:

Late Fee split - is set upon loan creation (shown at the beginning of this article) but can be reviewed at any time by going to the Modify Loan - Late Fees option.

Lender Fees - the same applies, when creating a lender fee you'll have the option to set the split between servicer and investor. You may want to create new lender fees according to the Investor/Servicer split you're seeking in differing scenarios.

This concludes the beta user guide. If you encounter any issues please report them by contacting Bryt support or submitting a detailed email (screenshots) to support@brytsoftware.com to help us track down bugs and improve your user experience.

Math Breakdown: Investment Fees (Investor/Servicer) Payouts

*$100,000 Loan, 12% interest rate, testing for 1% servicing fee

1) Take the principal balance ($100,000)

2) Multiply by the Investor(s) ownership (Our test scenario, 30%. From here, it's $100,000 x .3 = $30,000. Then you can divide here by the number of months in a year, or after the next step. $30,000 / 12 = $2,500)

3) Multiply by either the Investor's share or Servicer's share (In our scenario, we're looking to get a 1% servicing share from the investor. We take the full note rate of 12% and subtract 1% for 11% and multiply by the Investor's ownership principal: $30,000 x .11 = $3,300.

Then when we take the annual investor's interest and divide it by the number of months: $3,300 / 12 = $275

Alternatively, you could take the Investor's ownership amount from earlier: $30,000 / 12 = $2,500 and then multiply this by the Investor's cut: $2,500 x .11 = $275

Then if you're looking to check the Servicer's cut using the above example, you can do the opposite: $2,500 x .01 = $25

Then click 'Save' to save the new investor once they've been selected.

Then click 'Save' to save the new investor once they've been selected.