- 18 Feb 2025

- 2 Minutes to read

- Print

- DarkLight

Payoff Calculator

- Updated on 18 Feb 2025

- 2 Minutes to read

- Print

- DarkLight

Accessing the Payoff Calculator

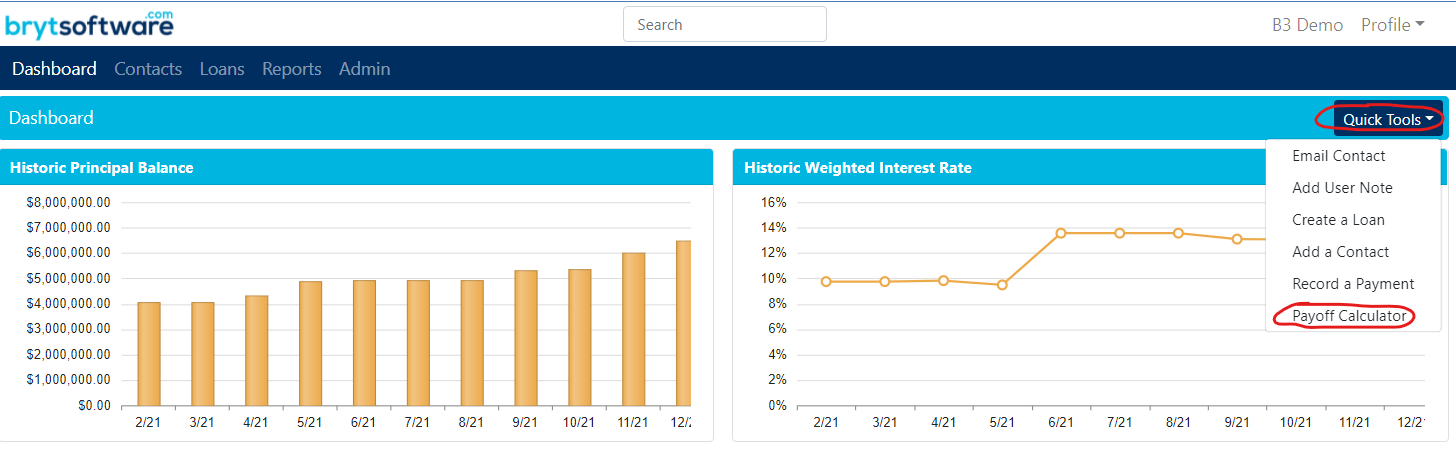

There are two ways to access the Payoff Calculator and both ways involve using the Quick Tools drop-down menu button.

- Click the Quick Tools drop-down menu button from your dashboard and click on Payoff Calculator.

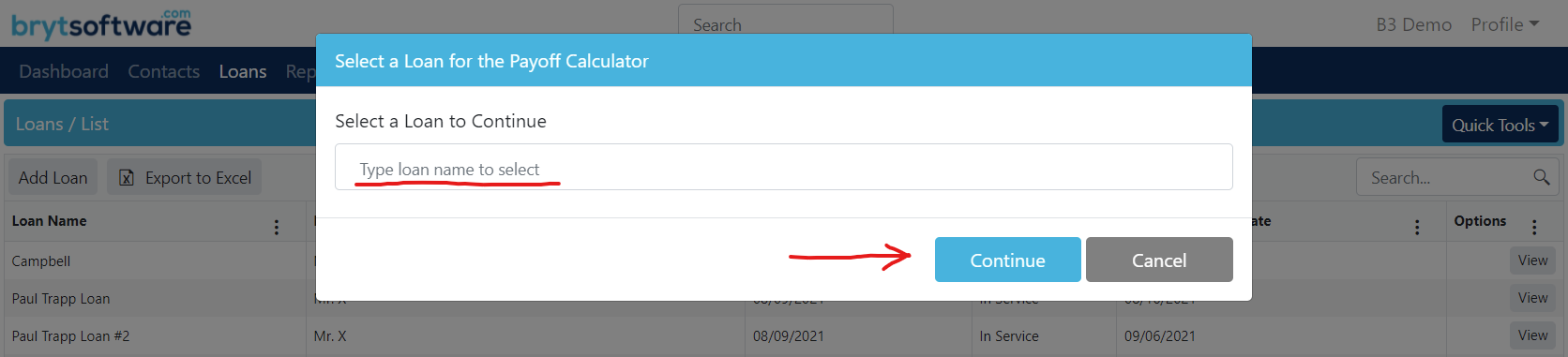

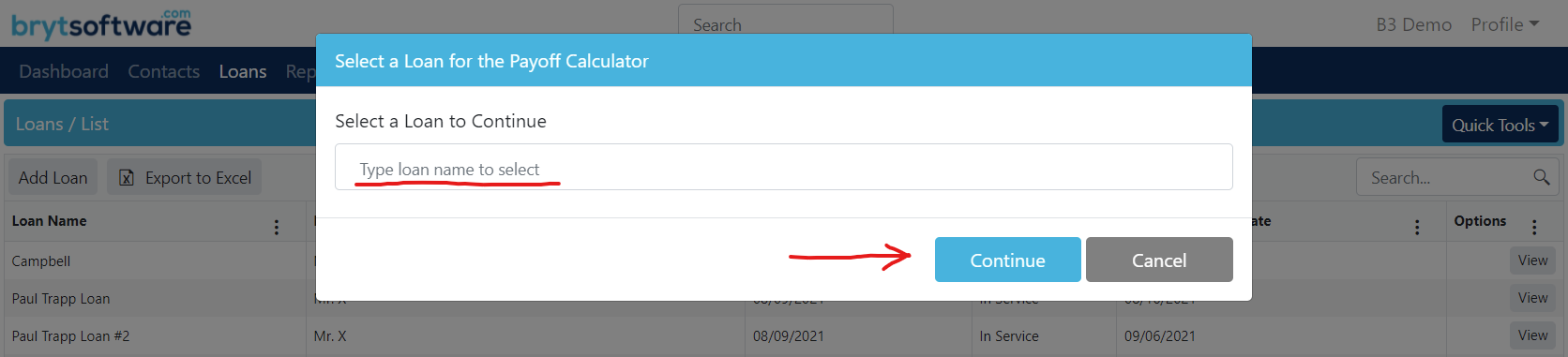

Then enter an existing loan name to select and use the Payoff Calculator for that specific loan.

Click on the loan you're trying to access and then hit Continue.

- While viewing a loan, click the Quick Tools drop-down menu button, and click on the Payoff Calculator.

Payoff Calculator Use Case Description

The Payoff Calculator helps the lender determine and inform a borrower how much they will owe given a selected Payoff Date.

The calculator also outlines other fees in an itemized format to help determine a borrower's status during a selected period, which would be the day the calculator is used, to the day the lender or borrower expects to pay off the loan. This is useful because it can show each time the interest rate was changed (variable interest rate), for how many days or periods, with a total every time the interest was changed.

Other fees include:

- Outstanding Interest - Outstanding interest accrued from a prior pay period(s).

- Late Fees - A fee charged when a borrower does not make a payment before the lender's set grace period.

- Outstanding Late Fees - Outstanding late fee amounts accrued from a prior pay period(s).

- Due Lender Fees - Custom-created fees by the servicer to charge the borrower.

- Outstanding Lender Fees - Outstanding lender fees accrued from a prior pay period(s).

It should be noted that late fees are not automatically included in the Payoff Calculator calculation. The calculator would only display them if there were an unpaid period on the day the calculator is used. Essentially, it cannot be used to predict future late fees.

The Payoff Calculator helps easily view interest accrual periods and are slightly different for each type, such as:

- Periodic - an equal 30-day period(s), or days of interest to be paid off.

- Actual Days - 30-31 days. Or more days are displayed by the calculator when a date beyond 31 days (from the current date to a selected Payoff Date) is chosen.

A Payoff Calculator example of the way days are displayed between a periodic and actual day loan type is shown below.

The start date for this example is 12/01/2021, the calculator use date is 1/28/2022, and the selected Payoff Date is 4/01/2022. Standard percentage-based late fee, one using actual days and another periodic, both using 360 days.

Lastly, if your loans carry Hold Account funds, you can toggle whether or not you'd like that amount to be accounted for when quoting your borrowers a payoff figure.