Tax Forms

- 11 Feb 2025

- 1 Minute to read

- Print

- DarkLight

Tax Forms

- Updated on 11 Feb 2025

- 1 Minute to read

- Print

- DarkLight

Article summary

Did you find this summary helpful?

Thank you for your feedback!

If you're looking to generate tax forms for a given tax year, this ability is typically made available within the first week of the new year.

Before generating tax forms, please ensure all payments with Paid On date values of 12/31/---- and prior are recorded on all your loans (if opting for the batch generation option). If any payments are missed, you can still generate them individually by going to a Loan or Contact's Documents tab and using the 'Generate 1098/99' button.

Guides for your reference are included below.

Guides

Batching (Mass Generation) Guide

Contact (Individual Generation) Guide

Additional Items for Consideration

- Bryt will only accurately sum values for generated tax forms based on loan payment dates. 2024 for example, the system will only include Paid On date values of 1/1/2024 to 12/31/2024.

- If you have been using Bryt inversely, for example, you set up your borrowers (1098) as investors/lenders (1099), then your account will not generate the proper form for you. You will want to create the tax forms outside of Bryt, here is a suggested resource: eFileMyForms

- Lender Fees Tax option: For each lender fee type, you can designate the paid amounts to be counted as Interest Paid on 1098/99 forms (Box 1 on both forms).

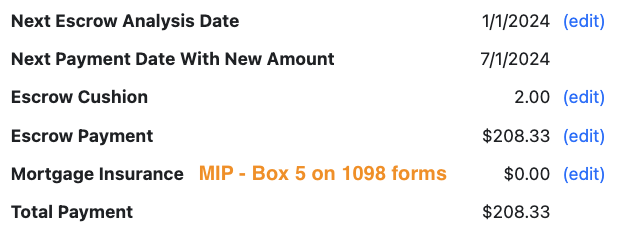

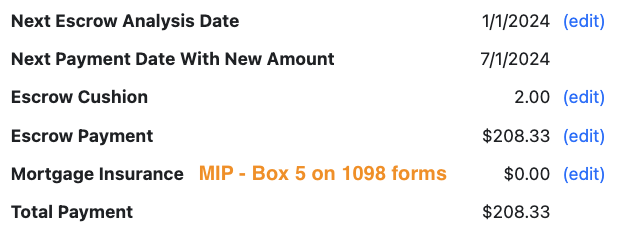

- Impound Tax Option: When you set up each impound fee, you can designate its paid amounts to be included as a Mortgage Insurance Premium (MIP - Box 5 on a 1098).

- Escrow Analysis Tax Option: This module's MIP (Box 5 on a 1098) amount is derived from the 'Mortgage Insurance' line item on the loan's Escrow tab. If you have used the 'Escrow Payment' option intending to include it on 1098 forms, please email support (support@brytsoftware.com) so we can assess your situation with our development team. Thank you.