- 12 Jun 2023

- 2 Minutes to read

- Print

- DarkLight

Understanding Payments and Amortization

- Updated on 12 Jun 2023

- 2 Minutes to read

- Print

- DarkLight

Amortization is paying off a debt over time in equal installments or Payments. On a loan with an interest rate and amortization amount, part of each Payment goes toward the loan principal and part goes toward interest. With Amortization, the amount going toward principal starts small and grows each pay period. Meanwhile, the amount going toward interest declines each pay period for fixed-rate (non-variable interest rate) loans. A loan with 0% interest and amortization would yield no interest payments (Principal Only), while a loan with an interest rate and 0 amortization would be an interest-only loan (Interest Only).

There are two ways to amortize a loan in the Bryt system:

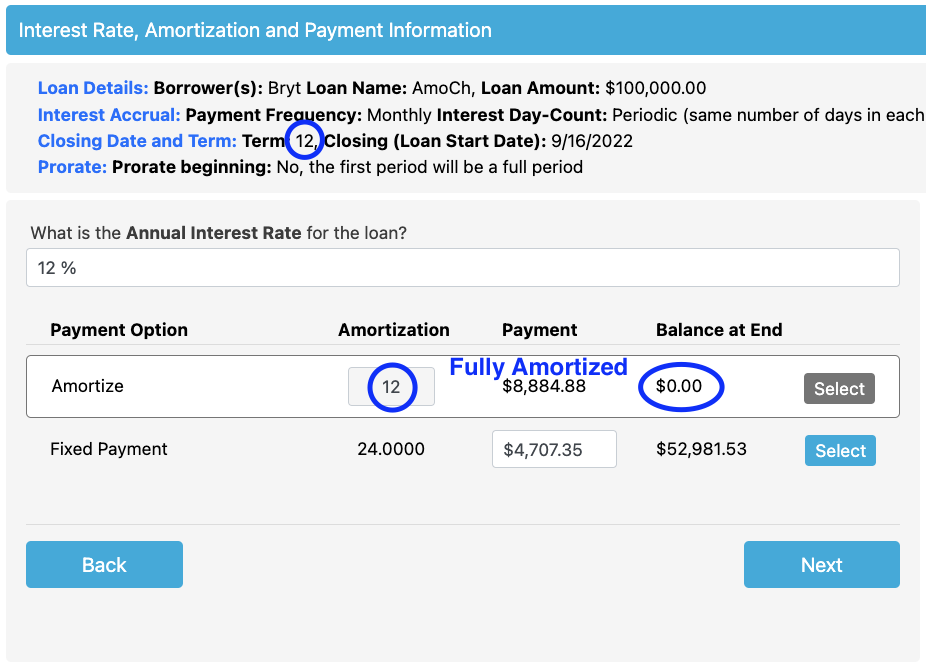

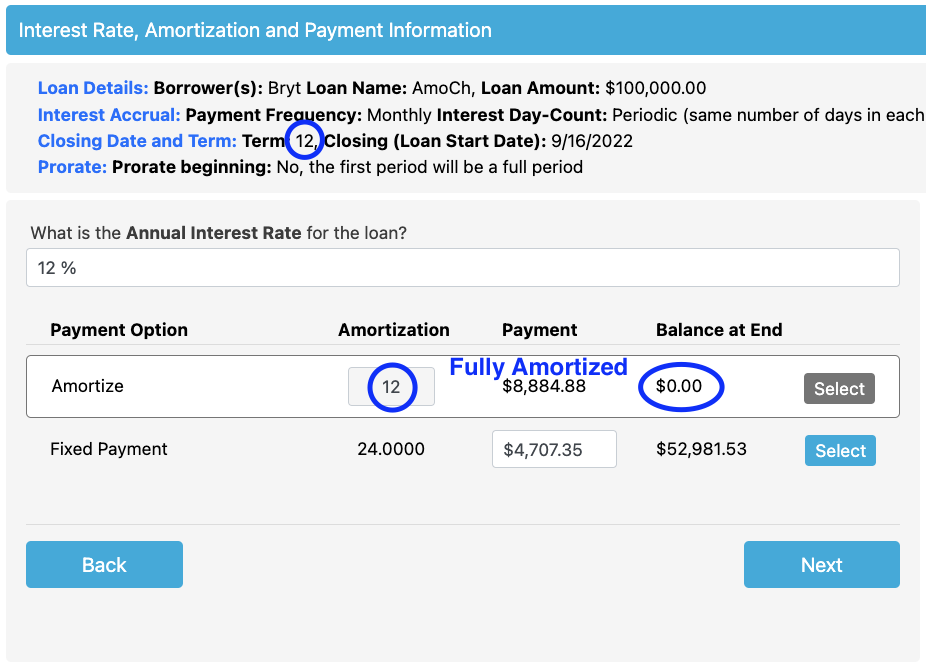

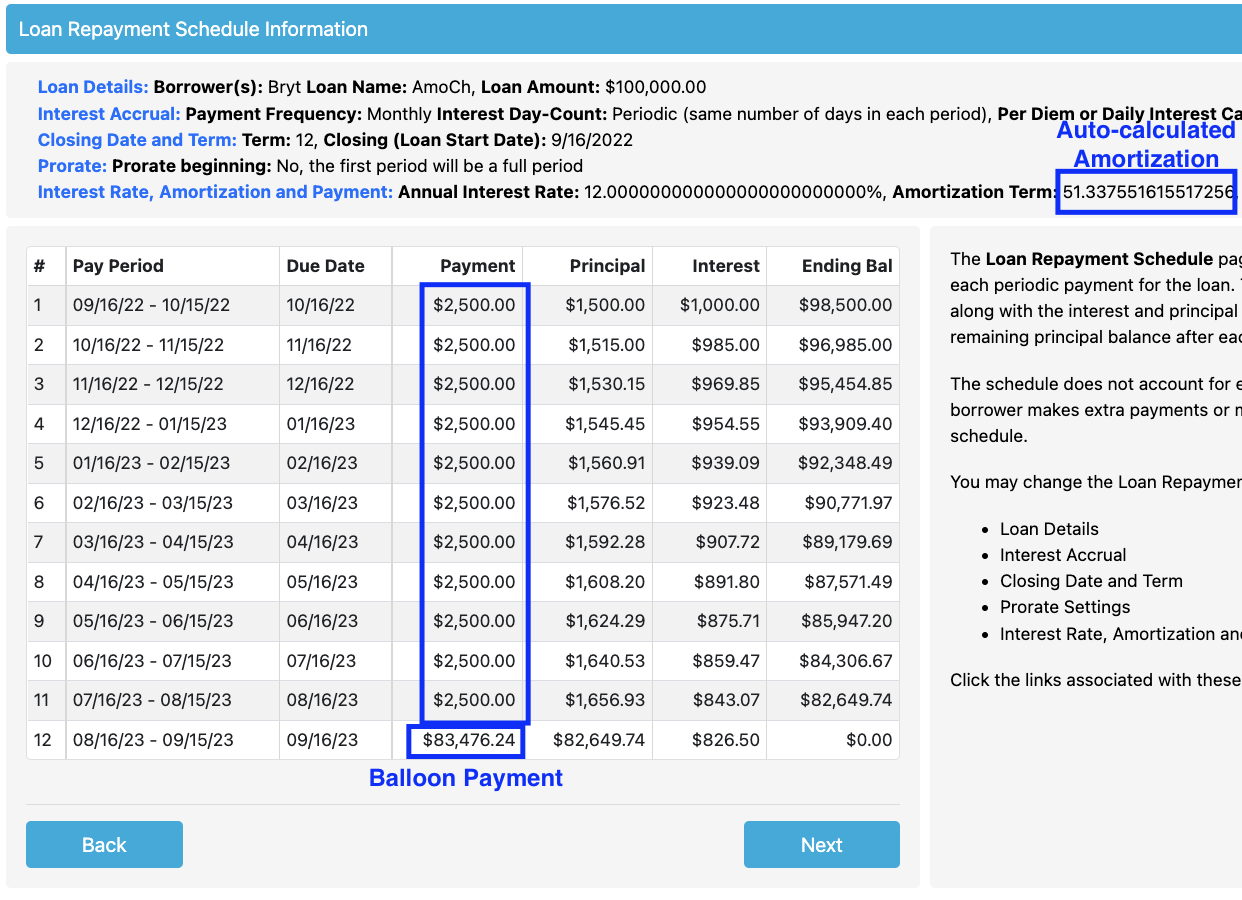

- Amortize - On a loan with an amortization (number of equally distributed payments over the life of the loan) amount that matches the number of terms in the loan, this loan would be considered 'Fully Amortized' since it'll zero out at the last pay period (at as close as it can, give or take dollars or cents.)

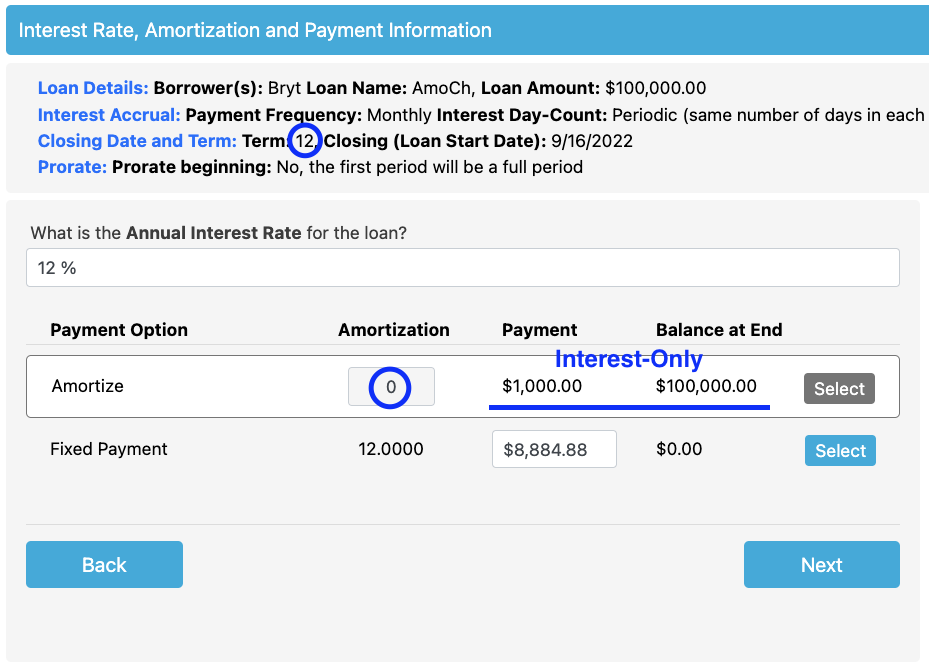

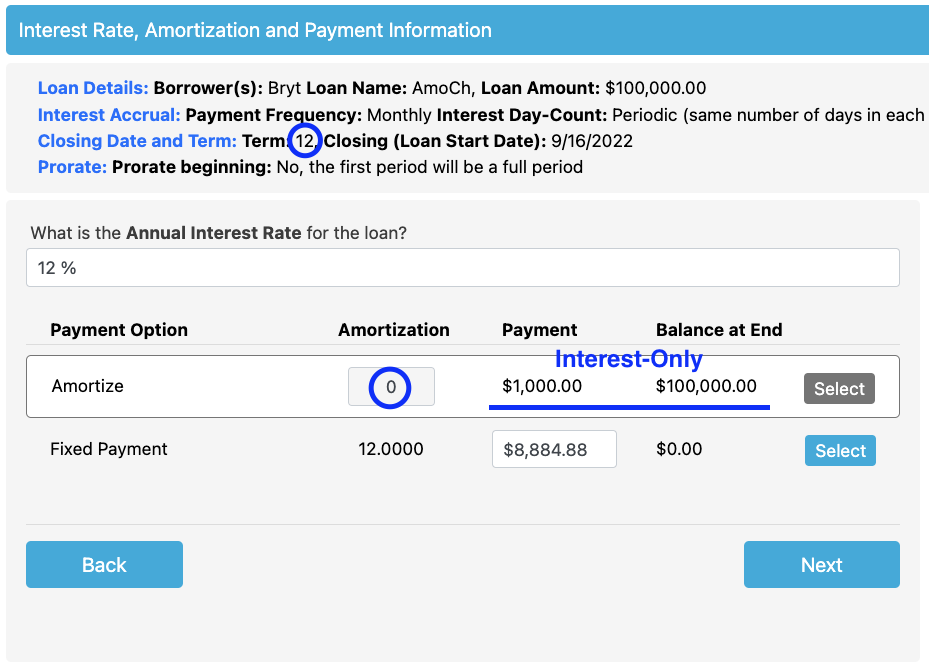

The Amortize option will also allow you to set an Interest-Only (Revolving - Line of Credit/Draws) loan by entering a '0' in the Amortize box.

The Amortize option will also allow you to set an Interest-Only (Revolving - Line of Credit/Draws) loan by entering a '0' in the Amortize box.

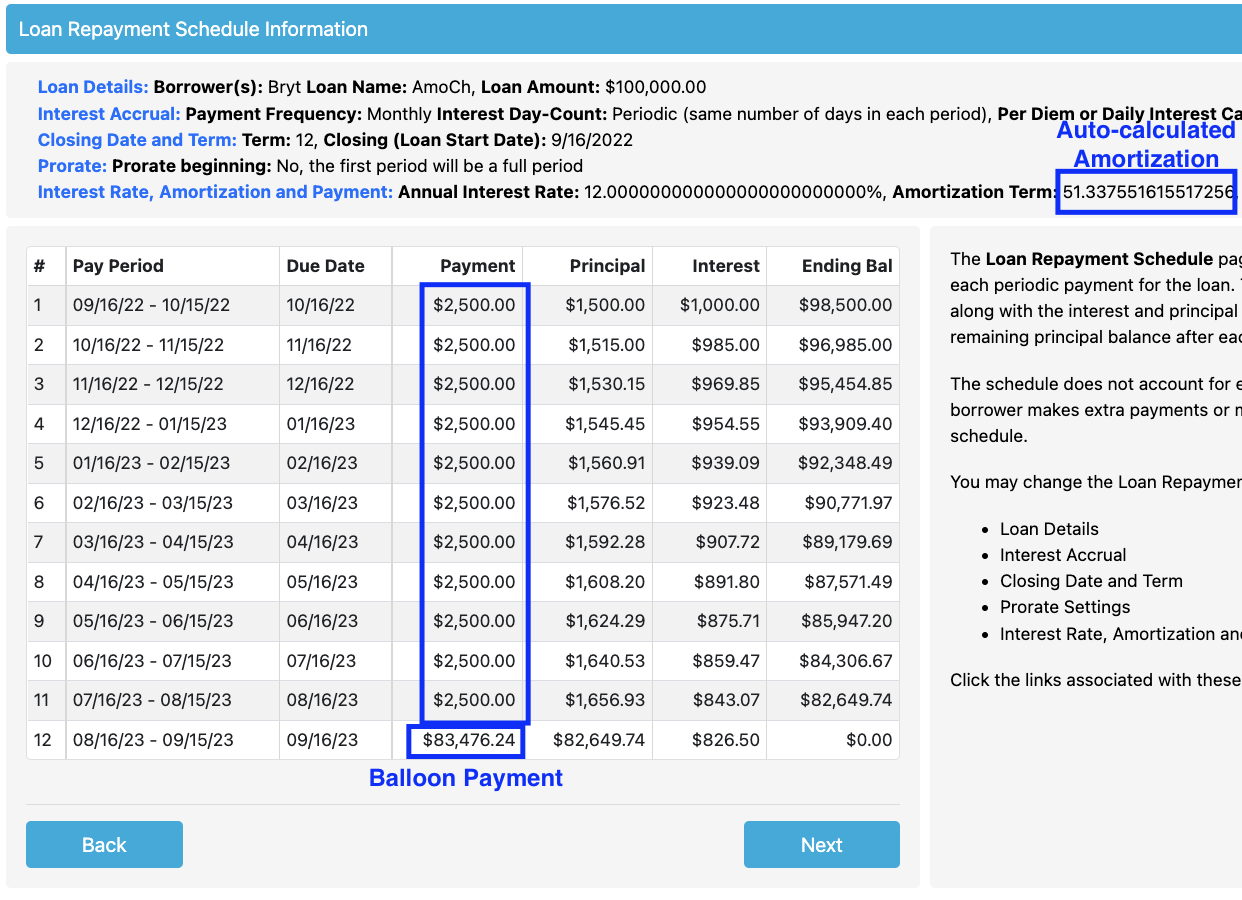

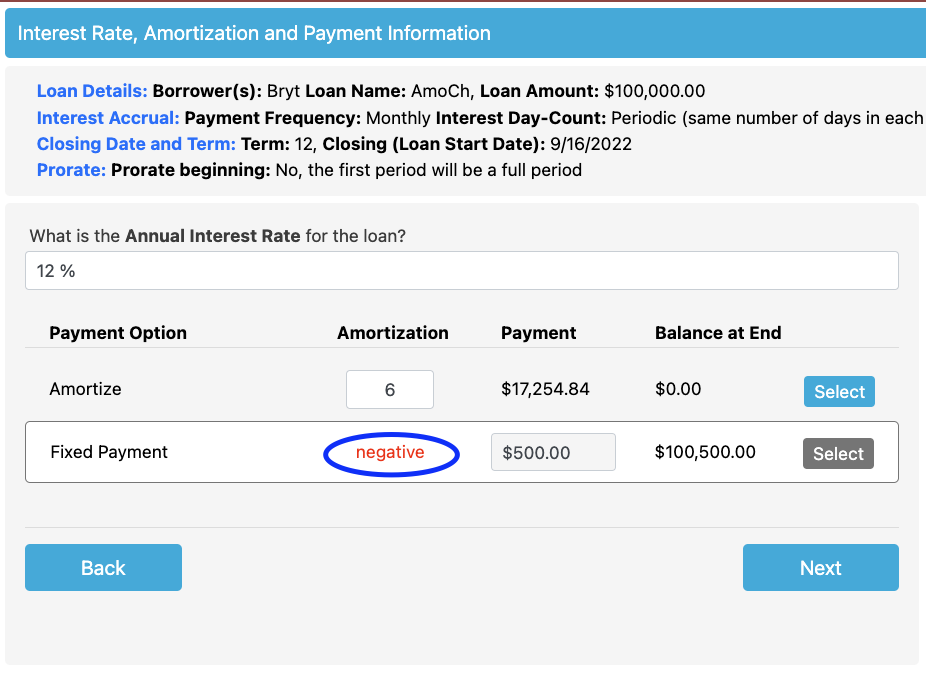

- Fixed Payment - As the title states, you can select a desired fixed payment amount for this option. This would technically be a 'Partial Amortization' option due to the fixed payment amount, when entering the amount, the amortization will be auto-calculated.

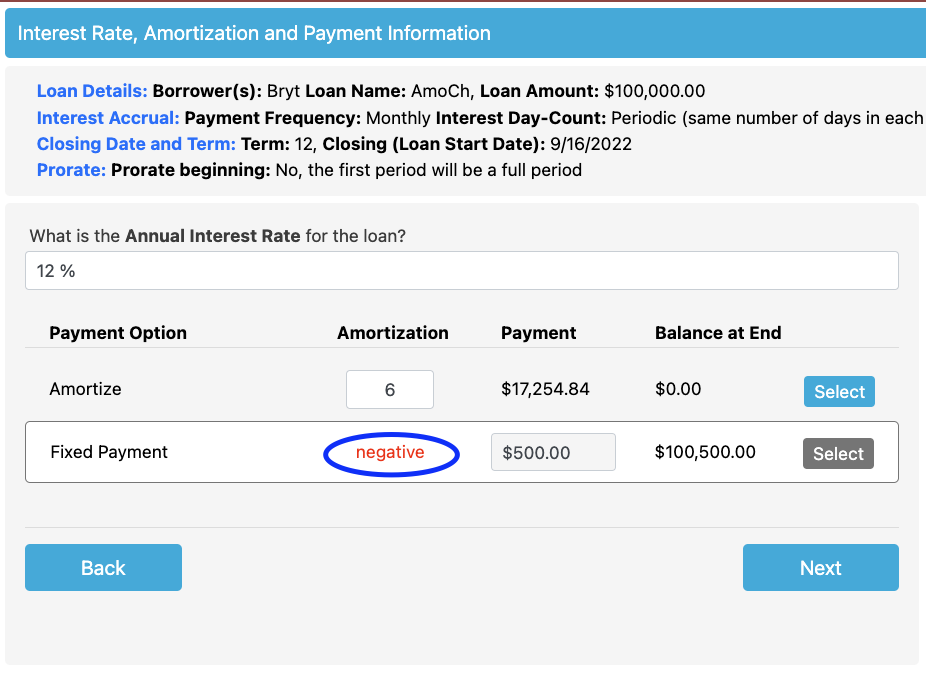

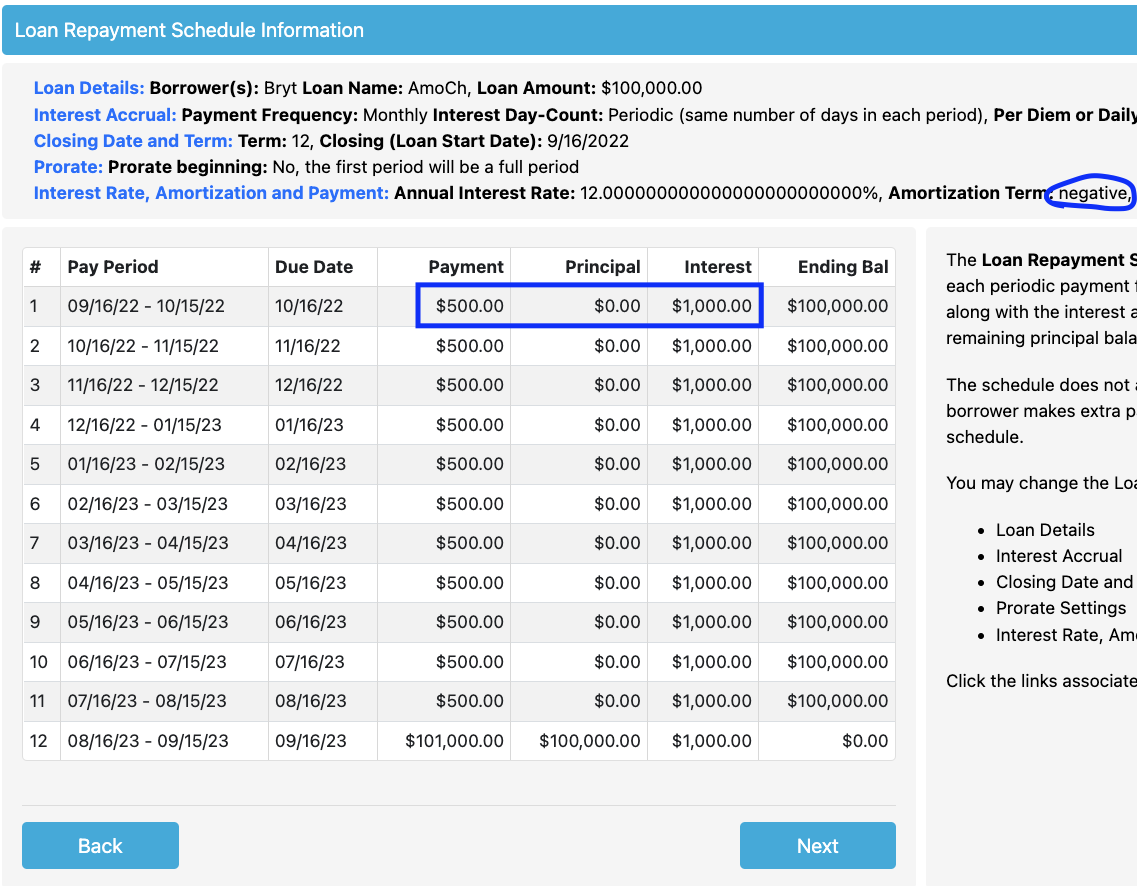

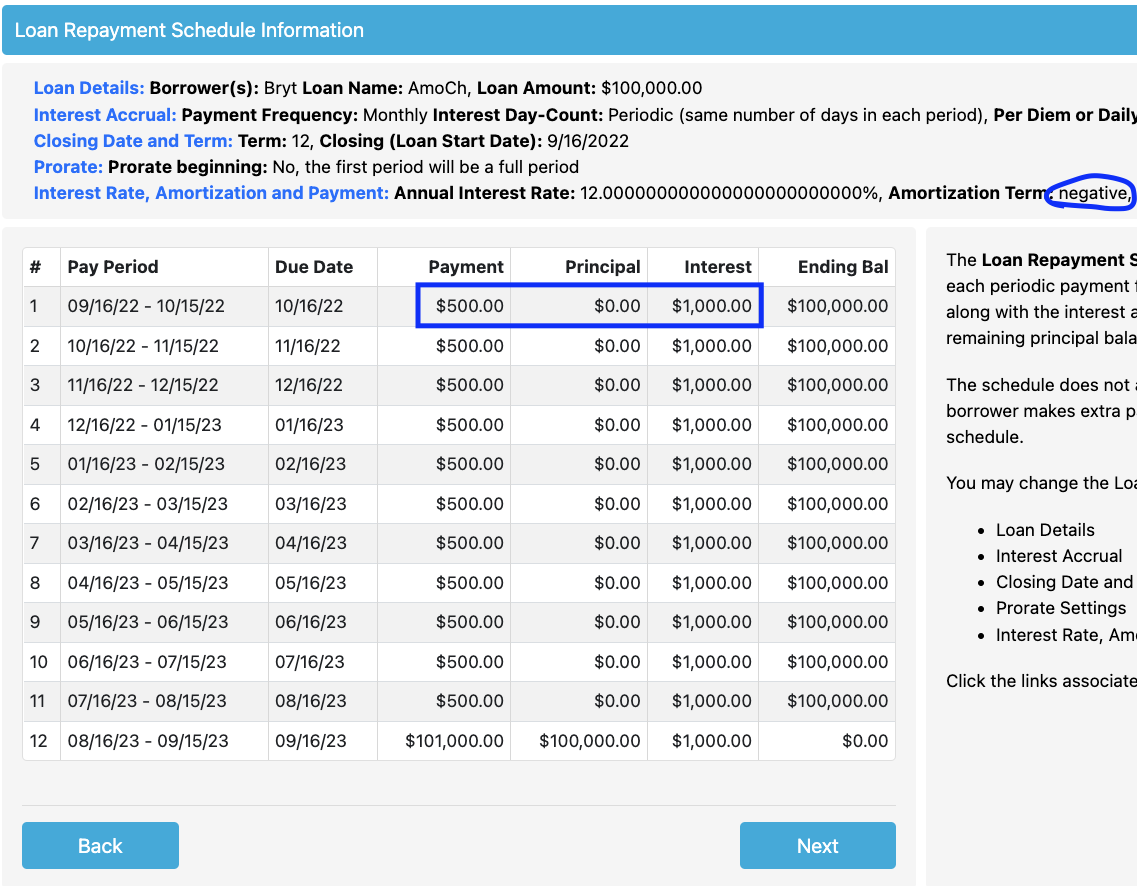

This option can also be negatively amortized (big balloon payment at the end) when entering a fixed payment less than the loan's interest-only payments. In this case, the schedule will show $1,000 due in interest with a due payment of $500, therefore each recorded $500 payment will leave $500 as Outstanding Interest.

This option can also be negatively amortized (big balloon payment at the end) when entering a fixed payment less than the loan's interest-only payments. In this case, the schedule will show $1,000 due in interest with a due payment of $500, therefore each recorded $500 payment will leave $500 as Outstanding Interest.

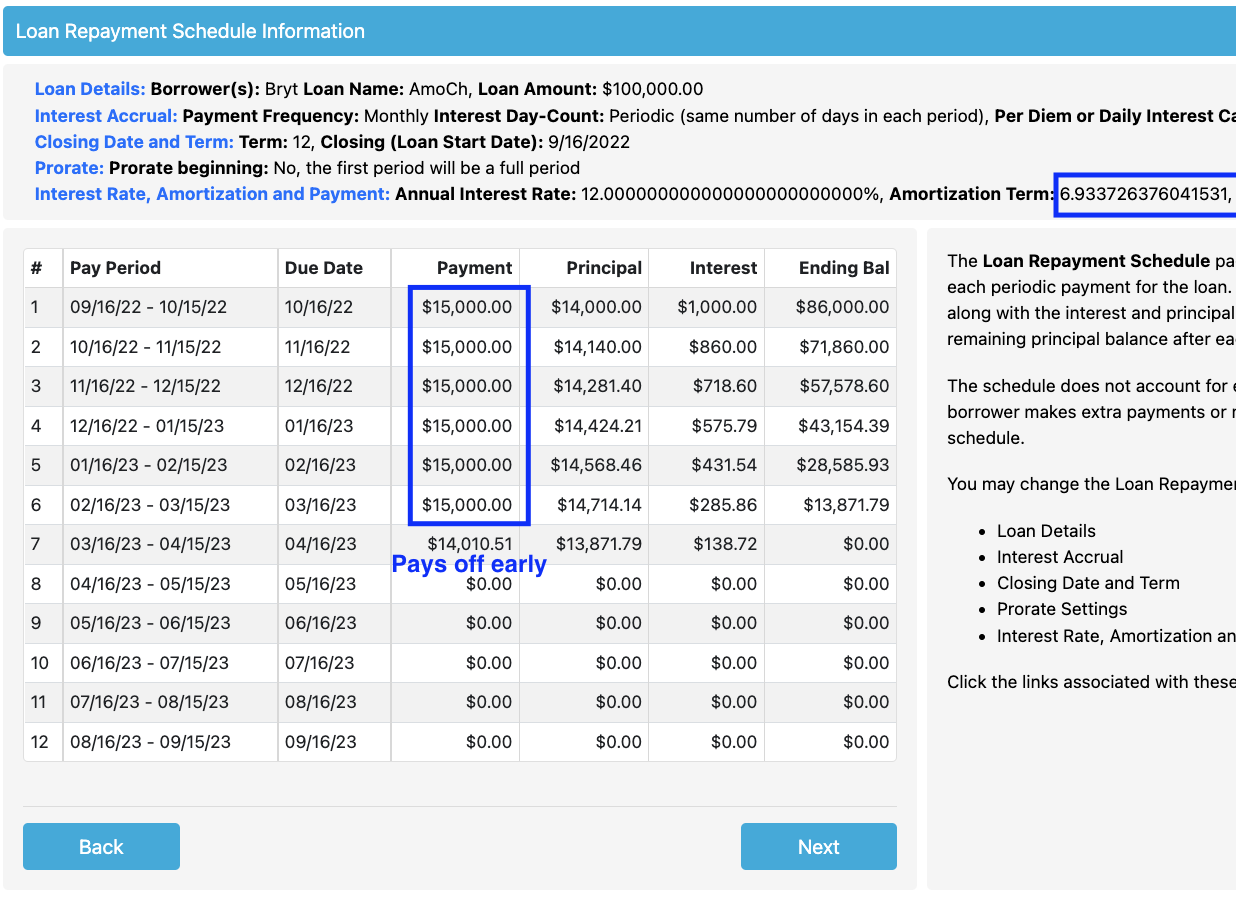

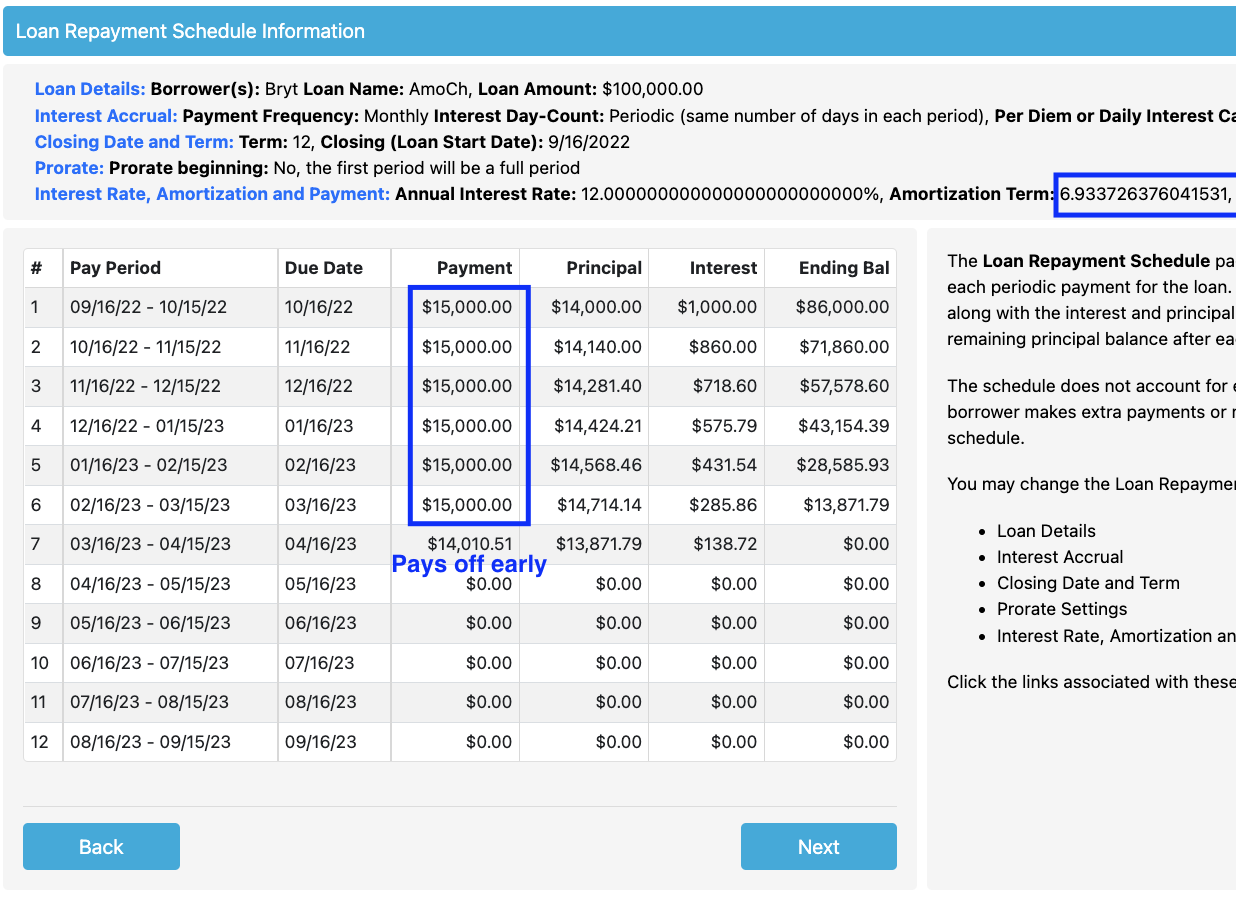

The opposite can be true if entering a payment greater than the expected amount to have the loan fully amortized, would end expected payments over the loan's terms earlier.

The opposite can be true if entering a payment greater than the expected amount to have the loan fully amortized, would end expected payments over the loan's terms earlier.

How Bryt Calculates Interest:

The principal balance (Loan Amount) is multiplied by the interest to get the amount of interest in a year, then it’s divided by 12 (months in a year). From there we get our interest per month and designate the interest accrual details such as periodic (30) or actual days (28/29/30/31), we divide those numbers to get our per diem. Once we have our per diem, we check the number of days (from the closing date or the number of days elapsed) to determine how much interest accrued and is to be paid.